Tailored to Your Practice Needs

Optometry Practice loans

Unleash Growth with Customized Funding Solutions

Our Process for Optometry Practice Loans

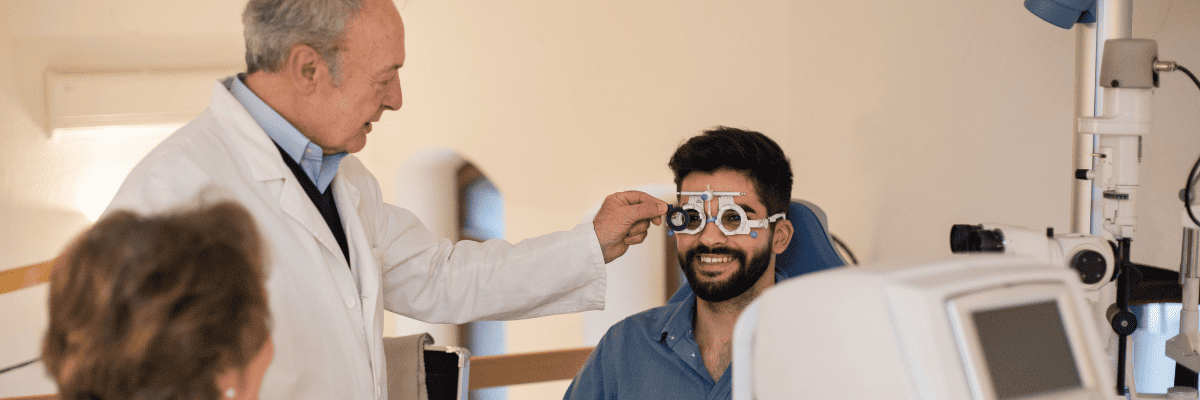

At Keyona Financial Services, we understand optometry practices’ unique cash flow needs. Our experienced financing experts works with you to assess your specific requirements, ensuring you get the right amount of funding at the right time. We offer tailor-made financing solutions designed to support the growth and success of your practice, helping you manage day-to-day operations, invest in new equipment, or expand your services, all with competitive rates and terms.

We know that access to working capital can make all the difference for your optometry practice. That’s why we offer quick and easy financing options so you can get the funds you need.

Keyona Capital sources the following funds:

100% Medical Practice Loans

At Keyona Financial Services, we are proud to offer 100% medical practice loans, a unique financing solution tailored specifically to the needs of optometry practices. These loans cover 100% of the expenses tied to your practice, such as purchasing new equipment, remodeling your office, or even acquiring an entire practice. Our 100% financing option encompasses a comprehensive range of purposes, allowing you to take your practice to new heights.

Optometry Practice Acquisition Financing

Acquiring another practice is a significant step towards expanding your optometry services. At Keyona Financial Services, we specialize in providing acquisition financing tailored to your strategic growth plans. Our team understands the complexities of such transactions, offering financial insights and support throughout the process to ensure a smooth financing process.

Acquisition financing from Keyona Financial Services ensures you have the capital to purchase an existing optometry practice, expanding your patient base and service offerings. Our customized funding solutions provide the flexibility to negotiate the best acquisition terms, enabling you to capitalize on growth opportunities without straining your current financial resources.

Our Optometry Practice Acquisition Financing goes beyond merely providing funds. We aim to be your strategic partners, helping you evaluate potential acquisitions, understand their financial implications, and ensure your decision aligns with your long-term business goals. Our comprehensive, personalized financing solutions allow you to take the wheel and steer your practice towards future success.

Debt Consolidation Loans for Optometrists

Optometrists often juggle multiple loans, each with their own repayment terms and interest rates. This can lead to financial stress and distraction from your core practice. Keyona Financial Services offers Debt Consolidation Loans specifically for optometrists, enabling you to combine all your existing debts into manageable loans with favorable terms.

Our Debt Consolidation Loans allow you to streamline your financial obligations, providing the opportunity to lower your monthly payments and secure a lower interest rate. This simplification of your debts can free up capital that can be reinvested into your practice, fueling further growth and increasing profitability.

Choosing to consolidate your debt with Keyona Financial Services not only helps improve your financial management but also offers peace of mind. Our concierge financing experts work closely with you to understand your financial situation and tailor a consolidation plan that aligns with your practice's objectives. With Keyona, you're not just consolidating your debt but paving the way for your practice's future success.

Optometry Practice Relocation, Expansion, or Remodeling Loans

Keyona Financial Services supports optometrists looking to relocate, expand, or remodel their practices. We understand the capital-intensive nature of these ventures and have tailored our loans to facilitate these projects. Whether you are relocating to a more strategic location, expanding to accommodate more patients, or remodeling to improve your services, Keyona Financial Services provides financial solutions that fit your specific needs.

Our loans for relocation, expansion, or remodeling offer competitive interest rates, flexible repayment terms, and quick approvals. This loan can cover many expenses, including leasehold improvements, purchase or lease of new equipment, and other costs associated with relocating, expanding, or remodeling your practice. Our team of experts works closely with you to determine the optimal repayment plan based on your cash flow, ensuring repayments do not impede your practice's operations.

At Keyona Financial Services, we help optometrists elevate their practices to new heights. Our robust and personalized financial solutions are designed to support your vision, fuel your growth, and enhance your services. We go beyond just funding, offering comprehensive support and financial advice to ensure your venture into relocating, expanding, or remodeling your practice is prosperous and beneficial.

Optometry Partner Buy-In or Buy-Out Loans

Keyona Financial Services also offers financial solutions tailored for Optometry partner buy-in or buy-out. Our financial products enable potential partners to invest in an existing practice or facilitate partners looking to exit. Understanding the complex dynamics and financial implications of partner transitions, we structure our loans to ensure smooth and efficient transactions.

Optometry partner buy-in loans are designed for optometrists looking to acquire a stake in an existing practice. We offer competitive interest rates, reasonable repayment terms, and expedited loan processing to help you secure your ownership swiftly and without hassle. Our team of experts will guide you through every step of the process, providing thorough financial advice to aid in your decision-making.

In contrast, our optometry partner buy-out loans are ideal for current partners wishing to buy out another partner's share in the practice. Like our buy-in loans, these are structured to provide financial ease and flexibility. We work closely with you to understand your practice's financial standing, devising a repayment plan that aligns with your practice's cash flow. This way, we ensure that the buy-out process does not disrupt your practice's financial stability or impede its growth. At Keyona Financial Services, our commitment is to your practice's success and prosperity.

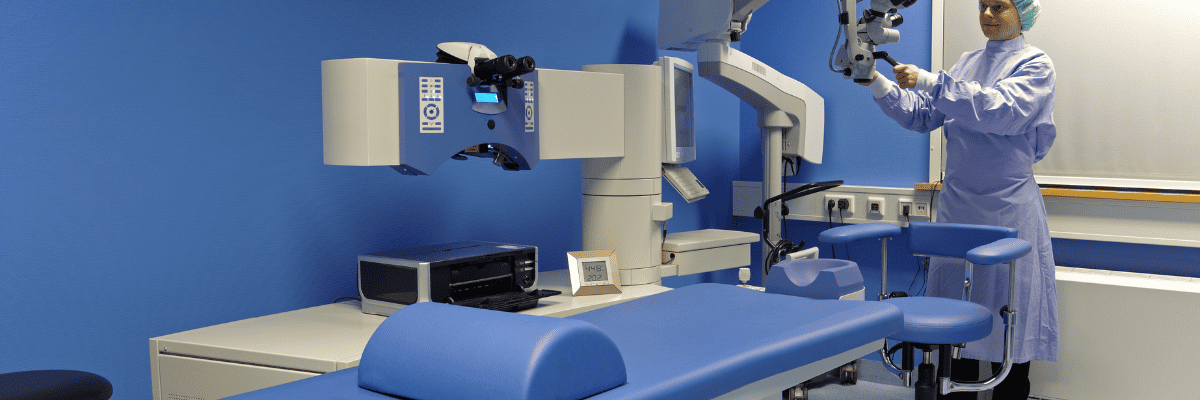

Equipment Loans for Optometrists

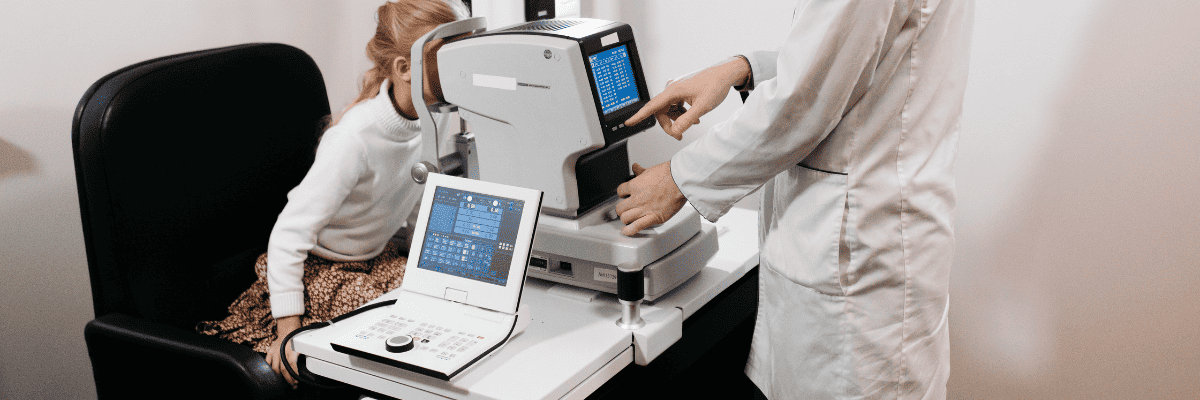

At Keyona Financial Services, we understand that having up-to-date and high-functioning equipment is essential for the success of an optometry practice. Therefore, we provide Equipment Loans specifically designed for optometrists. These loans facilitate the purchase of the latest tools and equipment, ensuring your practice remains competitive and provides the highest quality of care.

Our Equipment Loans are not just restricted to purchasing new equipment; they can also cover the costs of upgrading existing equipment or repairing crucial machinery. Our competitive interest rates and custom repayment plans make acquiring essential optometry equipment financially manageable. We aim to support you in maintaining an advanced practice that meets the evolving needs of your patients.

Our team of financial experts will guide you through the application process, providing advice and assistance at each step. From helping you assess your requirements to finalizing the best finance option, Keyona Financial Services is committed to ensuring your optometry practice is fully equipped to achieve continued success and growth.

Commercial Real Estate Loans for Optometrists

At Keyona Financial Services, we recognize that the location and quality of your practice's physical premises significantly influence the success of your optometry business. Whether expanding, relocating, or planning to build a new clinic, our Commercial Real Estate Loans designed explicitly for optometrists can provide the financial support you need.

Our Real Estate Loans offer competitive interest rates, flexible repayment plans, and significant loan amounts, allowing you to secure prime real estate for your practice. We prioritize understanding your long-term goals and the unique aspects of your practice to offer a loan structure that aligns with your financial situation and business strategy. This approach ensures the loan process is seamless and the repayment doesn't stress your cash flow.

Our financial experts are on hand to guide you through every step of the process, from the initial application to the finalizing of the loan terms. We believe in fostering enduring relationships with our clients, and our commitment to your success extends beyond just offering a loan. With Keyona Financial Services, you have a partner ready to support you in taking your optometry practice to the next level.

Startup Optometry Practice Loans

Starting up an optometry practice demands substantial initial investment, and at Keyona Financial Services, we are here to support you in this critical phase. Our Startup Optometry Practice Loans are designed to provide the financial backing you need to kick-start your venture. These loans can fund many startup costs, including equipment purchase, property lease or acquisition, initial inventory, and working capital.

Our loan solutions are tailored to meet the unique needs of optometry startups. We understand that a one-size-fits-all approach is not applicable in this scenario, so we offer flexible loan terms and competitive interest rates. Our financial experts work closely with you to understand your business plan, financial projections, and long-term goals, which enable us to structure a loan solution that complements your startup strategy.

At Keyona Financial Services, every business deserves a chance to succeed, irrespective of its size or stage of establishment. That's why we've created our Startup Optometry Practice Loans - to give your new optometry practice the financial boost it needs to thrive. With us by your side, you can focus on what you do best - providing outstanding care to your patients.

Optometrist Startup Working Capital Needs

Working capital is the lifeblood of any optometry startup. It's the fund that facilitates the day-to-day operations, ensures service continuity, and fuels growth initiatives. Regular expenses such as employee wages, rent or mortgage payments, utilities, supplier invoices, and maintenance costs fall under working capital needs. Further, unforeseen circumstances or emergencies require having a safety net, and this is where working capital comes into play.

In the initial stages of your optometry practice, your revenue might not be enough to cover these expenses, which makes the role of working capital crucial. It allows your practice to operate smoothly during this period of revenue build-up without any disruptions. A lack of sufficient working capital can lead to operational setbacks and even the risk of business failure.

Keyona Financial Services understands these challenges and is prepared to help you address your working capital requirements. Our comprehensive financing solutions cater to your immediate, short-term, and long-term working capital needs, helping you manage cash flow effectively. With our customized loans, you can ensure your optometry practice remains financially healthy and ready to serve your community.

Our Three Step Process

Our process is simple and straightforward. We start by having a free consultation with one of our specialists to discuss your needs and find the best loan option for you. Then, we will review your application and provide you with loan recommendations. We are with you through the entire process.

Step 1

Have a free consultation to discuss your needs and find the best loan option for you.

Step 2

We match you to the right lender based on the finaning you need and provide insights to inform your decision.

Step 3

We facilitate your loan through the application process to closing and provide ongoing support.

Talk with a Specialist

Our team at Keyona Capital is dedicated to helping optometry practitioners achieve their goals of growth and success. We understand that each optometry practice is unique and requires a tailored approach. That’s why we offer a free consultation with one of our specialists to discuss your needs and find the best loan option for you.

We are here to provide the necessary financial support and expertise so that you can focus on providing exceptional care for your patients.